Maximizing the value of your property management firm: Six tactics to maximize the value of your business

For managing brokers / owners considering retirement in the not-so-distant future, selling for a maximum price is important to set you up well for your golden years. You’re likely envisioning a sale in which you receive top dollar for what the business is worth. But depending on how you handle the process and business acumen, it may or may not go exactly as you’d hoped.

At Smythe, we’ve worked closely with many owners of privately held businesses, providing them with valuation, divestiture and acquisition services. The ideal outcome is for a business owner to obtain multiple offers that meet or exceed their valuation expectations, with most or all of the proceeds received upfront. For owners that prepare well in advance, this is a realistic outcome, however in many cases, ill-prepared sellers often face buyer-friendly terms, or there are simply no offers put on the table. It can be very disheartening, when you thought your business would be highly valued by prospective buyers.

Fortunately, there are some steps you can take put yourself in the best possible position, which we’ve identified below:

Diversify your customer base

generally, a business that has limited client concentration is less dependent on a cornerstone client, and is perceived as less risky by a buyer, which translates into a higher price. Buyers typically don’t want a single client to account for more than 10 per cent of total revenues (e.g., a high concentration of managed units or properties owned by one real estate group). Having a substantial amount of income and profits coming from a single source is a risky proposition for a new owner, which may result in either limited interest, or a sale where a seller may only receive proceeds if the customer is retained for a couple of years after the sale.

Recurring revenue

Recurring revenue is a fundamental element within the property management industry, which is a highly desirable component of value for buyers and investors. If service contracts are in place and where property managers continually innovate and provide customized value-add service programs, they are able to improve client retention. All of these efforts help increase revenue and profitability margins and client retention, which translates into more stability and a higher valuation.

Good and improving cash flow

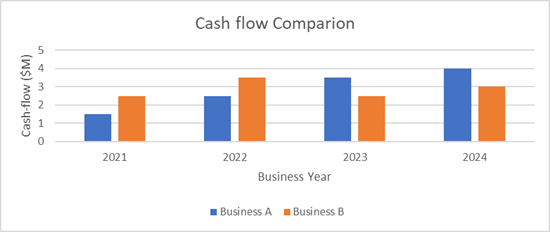

An upward trend in cash flow is attractive to potential buyers. In the chart below, we compare cash flow over several years between two businesses. Business A will be more attractive to a buyer than business B, despite the two companies realizing the same cumulative cash flow over this period. Why? Business A has a track record of steadily increasing cash flow over the years measured, and can be convincingly projected into future, post-sale growth.

And if management can steadily improve its operating margin, even with slowing revenue growth, the resulting increase in cash flow will still be attractive to a buyer as it is more efficient in its pricing and service delivery.

Demonstrated scalability

When your profit margins increase as revenues increase, then you have a scalable business. That’s appealing to buyers because of economies of scale. Increasing revenues does not necessarily mean similarly increasing costs at the same rate.

For example, property management firms are affected by scalability because their revenues are based on the capacity of the individual property / strata manager. In other words, there will be an increase the number of managers, while other costs rise in tandem with revenue.

Contrast that to a software development firm that is highly scalable– where the software development cost, once created, is almost nothing. But additional licensing sales generate increased revenue, profit margin, and cash flow.

By using efficient operating systems, CRM systems and competitive service delivery tools, you can improve your profit margins as revenue increases.

Competitive advantage

Your company’s competitive advantage is the reason your customers do business with you instead of your competitors. If you can capitalize on your unique selling proposition and direct your marketing and sales efforts accordingly, you will create continued demand for your services and increase their perceived value.

Also, if you allocate your growth capital to develop new services and customer solutions that better serve existing and potentially attract new customers, you are creating a competitive advantage.

Financial reporting & management:

Sloppy financial reporting might indicate there’s an underlying problem in your business. Even worse, it might can affect your ability to sell the company for its fair value and with the best terms. Good financial reporting allows you to manage for the future and react to changes in a timely manner. Without this, purchasers might believe the company is not prepared to meet its obligations and responsibilities to your customers and other important stakeholders.

With the help of your controller or accountant, be sure to have detailed cost and revenue recognition of your operations. That way, if growth accelerates, you can refine your account allocations with your managers by knowing the overall cost to service these accounts. And if you need to hire extra staff, then you will be able to better predict cash flow demands on your company to support it.

Buyers also place high value on firms that utilize detailed and systematic CRM or account management system (e.g., Yardy, Rent Manager) to track management agreements, billings, service calls, unit profiles, etc. Such reporting makes it more efficient to define business synergies across a merged operating company.

Most entrepreneurs will intuitively respect these six concepts and consider them as basic. The difficulty comes in staying focused and making these strategies a priority in the day-to-day management of your property or strata management business.

The rewards of being able to increase your business’s value and to ‘cash out’ on your own terms and expectations are worth the effort.